Fed Queen

Daniella Cambone asked Jim Rodgers in a recent Stansberry Research interview what he would do if he were made chairman of the Federal Reserve. Without hesitation Jim said he would resign. The David Gilmour line “There’s No Way Out of Here” came to mind.

In a Wealthion interview Adam Taggart asked Danielle DiMartino Booth the same question. By contrast, Danielle did not back away, instead taking a play out of the Paul Volcker playbook. Here is her response:

I would certainly completely get of Mortgage Backed Securities QE. That would be the first thing, and I wouldn’t Taper, I would rip the Band Aid off and I would say we are doing more harm than good.

And I would communicate that Zero Interest Rate Policy has been a failure; that it has time and time again fed financial instability and therefore the Fed was going to establish a new floor of two percent, never again to be breached, such that the boom and bust cycles that have been fomented by Zero Interest Rate Policy are not to be repeated in the future.

These would be very unpopular things! The 20% of US Corporations that are Zombies would go away. But longer term that would open up the universe for new entrants, for new job creators, for innovators. Heck, China’s allowing more defaults now than the United States!

We have to get rid of the Zombies to make up for the sins of the past and we have to acknowledge that Zero Interest Rate Policy has been a failure, and we have to get out of the Housing Market.

To Danielle’s comments, Adam added:

So you embrace the cleansing fire. Let’s take our lumps, but let’s get it over with and we’ll be able to start a sustainable baseline after that rather than just trying to keep this whole house of cards propped up.

There are companies in America with strong balance sheets. There are companies in America that will weather what’s to come. There are companies with pricing power. So there are strong companies out there and survivorship bias will be a powerful force to contend with on the other side of whatever is to come.

The Creative Destruction which is a cornerstone of true Capitalism – we have taken that out of the equation, along with Price Discovery.

With all the intervention that has been going on you are advocating Creative Destruction. It’s going to be painful, but it’s the kind of pain that will be beneficial in the long run if we get all of the malinvestment cleared.

Very well said Danielle and Adam!

Forget Greta!

The US of A has some very, very serious problems that dwarf the Right vs Left bickering we see in the media every day. Some people dismiss the Deep State, but it is very real indeed.

About a year ago I became aware of certain irregularities from Catherine Austin Fitts and her Solari Report posts and videos on the work of Doctor Mark Skidmore of Michigan State University.

Dr. Skidmore set his graduate students digging through publicly available government budget documents looking for “Undocumented Adjustments” – like the minor tweaks you need to balance a check ledger or for a petty cash account that isn’t worth detailing.

These things are common in accounting, right? Well, the total that Dr. Skidmore found in these journal corrections was . . . twenty one trillion dollars.

Yes, that’s Trillion with a T! The budget office’s response to the attention generated by these discoveries was to pull the documents and to begin using a thing called FASB-56, a very convenient accounting rule that allows the deliberate misclassification of line item categories for “national security ” reasons.

Of course, people are asking where the hell is this money is going.

I’ll bet this is one. It quite honestly left me stunned! Did you know that aircraft jet engines do not produce vapor trails? So what are those contrails that crisscross the skies on any given day? Do some digging on “Climate Engineering” and “Geo Engineering”.

Those are streams containing nanoparticles, typically alluminum, being spread in the atmosphere to control climate. This has been going on probably since the forties!!

If there if there is anything that can be known for sure in life it’s that men trying to play God always ends badly. This IS ending badly!

This is no joke; mainstream scientists are sounding the cry. Forget Greta: here’s the source of your Texas Ice Storm; the Southwestern Drought; the California Wildfires; and those other anomalies people try to pin on conservatives and think they can fix with oceans of a dying Fiat Currency.

We’re screwed.

Alisdair McLeod on Basel III

Finance and economic expert Alasdair Macleod says a new rule change at the Bank of International Settlements (BIS), aka the central bank of central bankers, is going to help drive the price of gold and many other commodities higher.

The new rule is called “Net Stable Funding Requirement” (NSFR). It goes into effect by the end of June in Europe and by the end of the year in the UK where the London Bullion Market Association (LBMA) operates the biggest gold trading platform in the world.

The short story is this new BIS rule is going to stop paper contracts from conjuring supply of gold, silver and many other commodities out of thin air.

From Greg Hunter’s USA Watchdog:

The Wild, Wild West

A very interesting conversation on Market Anarchy came up in a Interview Adam Taggart of Wealthion did with Bill Fleckenstein last week:

Adam: I just want to read this quote I saw a few hours ago from Greenleaf Capital’s David Einhorn’s recent letter to investors:

Many who would never support defunding the police have supported – and for all intents and purposes have succeeded – in almost completely defanging, if not defunding, the regulators.

Quasi-anarchy appears to rule in markets … there is no cop on the beat. Companies and managements that are emboldened enough to engage in malfeasance have little to fear.

Adam: Are we letting the inmates run the asylum, and are they going to run it into chaos?

Bill: Where do you want me to start?

Bill: You know the Sarbanes-Oxley Act they passed after the bubble [2002]? It was supposed to be a crime to sign a financial statement that turned out to be inaccurate. We can count on one hand the number of people who went to jail in the wake of the ’08 financial crisis when so many of the financial statements were fraudulent, particularly those at the epicenter of the problem like Lehman and Baer Stearns.

Bill: You’re not supposed to use non-GAAP accounting methods. They [regulators] don’t care about that. They can’t catch the obvious stuff much less all the crazy crap that has happened.

Bill: They can’t possibly understand what they have allowed to happen with the Passive Investing getting so big. It’s a Systemic problem, but they can’t understand the obvious stuff, this is going to be way over their head, but it really should be in their purview!

Bill: So with them not doing their job at any level we are now left with this Wild, Wild West of the Marketplace that we have today!

Bill: Whose Job was it to make sure that firms didn’t allow the kind of leverage and swaps that we just saw with Mr. Crouching Tiger? [Bill Hwang, Archegos, formerly Tiger Management.] Credit Suisse managed to lose seven billion dollars on one account. Should that stuff be happening?

Bill: Some guy living in his Mom’s basement gets a tip, trades on inside information and makes a couple thousand dollars. They go after him!

No Cop on the Beat? Inmates Running the Asylum? The Wild, Wild West? Pick your metaphor, but there’s some “crazy crap” going on out there!

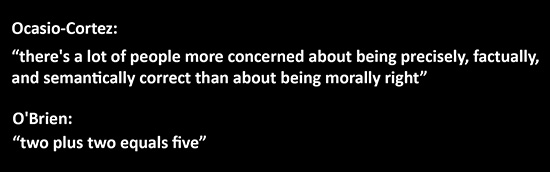

Double Plus Ungood

The Great Robbery

Great Podcast on March 30 on Arcadia Economics! Panelists were Chris Marcus, Chris Marchese, and Robert Kientz. Here is a link:

The Biden-era hyperinflation is now in full effect

These guys are good, but Robert did an absolutely great job detailing some of the evils of today’s financial and political world. Chris Marcus got it going with this comment:

Chris Marcus, Arcadia Economics:

This is a robbery of the system. These are people directly looting, raping, and pillaging a country they swore an oath to protect. I am having a hard time seeing it any other way, especially based on what I have seen in the last week or two. Rob, is that accurate?

And Robert responded with this. Note the topic summarizers are my own, but Robert’s words are transcribed directly.

Robert Kientz, GoldSilver Pros:

Silver Squeeze:

I think it’s gotten so obvious now that’s why you are seeing so many of our youth turning to the precious metals. You’re seeing people come the precious metals who you would not suspect and that’s why we are dealing with the silver squeeze movement. That silver squeeze movement is people starting to wake up and say what the hell is going on.

Regulatory Capture:

It starts with regulatory capture. We have a lot of the same people rotating between wall street and the government and putting in policies that benefit Wall Street. But now it’s getting silly because you’re seeing Yellen going from the Fed to the Treasury, so what’s the difference between the Fed and the Treasury, where’s your independence?

FASB-56:

Now you are seeing FASB 56, which allows the government to essentially take the real budget off the books and go black, so whatever bullshit they’re putting out in public you cannot count on because FASB 56 allows them to move money between different accounts and misreport it so whatever you see is a lie. The Constitutional requirement for the government to be honest with people about the finances is gone. The regulatory statute is, of course, unconstitutional but I don’t see anybody challenging it. So the government has granted itself unconstitutional powers to do whatever the hell it wants.

Undocumented Adjustments:

Then you are now seeing Dr. Mark Skidmore with what I think is now up to 145 trillion in “undocumented adjustments” so the money spigot has just blown wide open, and you would have to have your head in the sand, and be either corrupted or completely blind, or so scared you don’t want to admit what’s going on right before your eyes. So I agree with you, it’s is a robbery.

Pensions:

Something Catherine Austin Fitts said a while back: they have already robbed the pensions because they have stuffed them so full of liabilities they can’t be paid back and out the back door went all the value. So the pension systems are in serious trouble.

Robbery by Statute:

Through every way and means you can think of the system is being robbed. And it’s being robbed right in front of you. And it’s being done by statute. And the only way you can get a statute to rob the people is through Congress and through the government. So if you can’t trust your government, and you can’t trust the regulators because they are all captured, what exactly do you do?

Eroding Faith:

This is eroding faith in the system and this is where you get the Wall Street Silver and the Silver Squeeze movement, this is where you get people questioning the legitimacy of the Presidential election. I don’t want to turn this political, but I think for the first time since I have been alive people are openly questioning the legitimacy of a duly elected US President and the entire administration. I’ve never seen that in my lifetime, not to this extent.

I don’t know that any government edifice or body has any credibility right now with the American public, and certainly not with China and Russia who are basically laughing at the current state of the American government.

A Run on the Bank

Mints have offered Unallocated Silver Products like the Perth Mint Mid Certificate Program for decades. What a great idea! No fees, no storage costs, while still offering exposure to the spot price.

And it offers convertibility to Allocated Silver whenever you wish, although clients report the “whenever” part has become, to say the least, a bit fuzzy in the wake of record conversion demands.

Robert Kientz of Gold Silver Pros interviewed James Anderson of SD Bullion last week on this topic. See that interview here:

Archegos Meltdown Illustrates Risks of Unallocated Silver & Gold

Let’s hear what the experts had to say on Unallocated Silver:

Robert: We gave had a lot of noise recently over unallocated gold and unallocated silver. We’ve seen reports from deposit holders at ABC Bullion and The Perth Mint in Australia, and something came out today from John Adams on the Kitco Pool (John is an Australian Economist following this closely).

One of his readers reported that he was getting mixed stories as to if they will have back up the entire pool and that the wait to get physical silver is about a year.

What is your view on the risks of unallocated silver?

James: So, unallocated is basically an unsecured loan that you are giving a mint or a dealer. You get no interest, but you don’t have to pay storage fees. That is clue one; If you are not paying management or storage fees you are the product.

Essentially your cash is a loan to this company, and they’ll give you exposure to the spot price of gold and silver. If you come back and ask for your cash back it will likely track the spot price at that time. But that’s only if it’s just you. If everybody starts coming back and they are using all these loans? They are basically running a fractional reserve system here.

These different vehicles have been going on for a decade plus. The Perth Mid Certificate Program has been around since the early 2000’s I believe, and the Kitco Pool is the same story. I’m not sure about ABC Bullion, but for all three it’s simply where you’re giving an unsecured loan to a company or a mint and they’re using those funds to operate without interest expenses.

James points out that clients typically don’t understand that though they have exposure to the spot price, their claims to physical metals are based only on promises. He says, ”These are not intelligent bets.”

James: You’re running a huge risk. I think GLD and SLV are extremely risky also, but these [mints/dealers] are not even regulated companies.

I ran the numbers recently and there are roughly 2 billion Australian Dollars owed in the silver spot price. That’s a lot of bullion.

I think what you’re having right now is a run on these unsecured, unallocated systems.

A “feature” of any fractional reserve system. Think 1929. When depositors understood there were more claims on assets than assets, depositors rushed the Bank teller windows, pandemonium reigned, and Banks become insolvent.

If things get bad, these depositors in unallocated metals will become unsecured creditors. And unsecured creditors go to the end of the line! Not only will they never see an ounce of physical metal, they may never see their funds again.

James had some advice:

James: If I were personally in any of these accounts, I wouldn’t sit around waiting for a year to get the change into bullion. I just say “wire my funds – how long will it take until I get the bank wire.” That’s the key, just get your cash back and turn around and buy something trustworthy from a bullion dealer you trust.

Bottom Line, if you hear the term “Unallocated” – Run Like Hell!

The Simple Truth

Channeling Sun Tzu

“It is best to win without fighting” – Sun Tzu

Young Hong was a tough little Korean guy from Seoul who got on a boat and headed to the new world. He was a veteran of ROK Army and a master in the Martial Arts, neither of which seemingly qualified him for much in the way of employment in New York. His limitations in English didn’t help, either.

But he was here. He found work where he could, maintenance, construction. He was strong as an ox and a hard worker.

Before long he made his way to Chicago, linking up with Korean expats there. They found a career path for him: Karate was hot! GI’s brought it back from Japan, Okinawa, and Korea. Tae Kwon Do, the Korean style, was really popular.

Teaching was a challenge at first, but he got the hang of dealing with Americans; the harsh treatment the Senseis dealt out in Korea was a no-go here, nor would parents tolerate kids suffering concussions or broken bones.

But they were OK with discipline: you could be stern and make them do push-ups if they messed up, just not the rough stuff. Mister Hong had found his calling: he was a great instructor.

And an excellent practitioner: his Kata were excellent; so were his Step Sparring techniques; but his Free Sparing was off the charts! He was one hell of a fighter: nimble, fast, strong, athletic.

And smart! He could size up an opponent instantly: what was his reach, which side did he favor, what techniques were his best, did he drop his hands, or leave himself open after an attack, how was his stamina?

Once he had the book on someone they couldn’t hurt him. He played defense, dancing out of range, parrying blows, waiting for a mistake, an opening, for signs of fatigue.

Then, when the opportunity came he took it; took it decisively. If the guy was good a match could go a couple of rounds, if not he could be off the mat in a minute. He took home a lot of first place trophy’s for his Dojo.

Soon he was looking for his own place, away from Chicago. His buddies weren’t looking for competitors, so somehow he found Belvidere, maybe because of the Chrysler plant there. But that’s where a landed, a blue collar town of autoworkers and tradesmen.

He developed a student following, became a man about town, breaking down the town’s normal suspicion of foreigners. All he needed was an opening, his humor and good nature took care of the rest. Belvidere learned to love and respect their new martial arts master.

But he had lots of stories. He told me this one years after it happened. He walked into Red’s bar on North State Street. The drinkers stopped talking to look at him. Soon a big, burly guy came over. He repeated to me what the man said in his Korean pigeon “Hey! You Young Hong! You tough guy, I fight with you!”

Mr. Hong said “No. I not tough – I know little bit” and raised his hand to show a little gap between his thumb and his index finger.

The guy persisted: “You tough guy. We go outside. I fight with you.”

To me he said “I say myself, ‘I make that man my friend!'”

But to his protagonist he said, laughing “No my friend, I not fight with you – you beat me up!” and put his hand on the man’s shoulder. “We be friends. I buy you drink!”

Soon Joe, that was the man’s name, and Young Hong were drinking, trading stories, laughing and having a good old time in Red’s Bar on State Street in Belvidere, Illinois.

“Hey Joe, you come my studio. You watch!”

Joe did come to the studio the very next week and sat in the observation area to watch an advanced class: warmups; stretching, Kata; three steps; and sparring.

Free sparing: put on the gloves, foot pads, mouth guard and mix it up. Mixed it up big time on that day. Mr. Hong, one on two against his best black belts. They couldn’t touch him but he went in at will against either, dodging the other; tapping them on the stomach, the chest, the temples, the nose, showing he could take them down any time he wanted.

Joe watched, eyes open wide. Mr. Hong said after the class Joe was very quiet.

I didn’t know Joe, knew nothing about him, but I’ll bet it was a long time before he challenged another Korean to a bar fight.

The Clothesline School of Writing

Molly Daniels-Ramanujan

The old Studebaker Building was down and across from the Art Institute of Chicago on South Michigan. It was built for the manufacture of carriages by the Studebaker Brothers of South Bend, Indiana in 1884.

Now it was “The Fine Arts Building” though still served by its now ancient, elevators with a human operator in each: proficient with the metal cage gates and expert at lining up with the floors of the building using the antique lever mechanisms.

The Clothesline School of Writing was on the sixth floor: a single large classroom with folding chairs and banquet style tables arranged at right angles to make a large box. Molly sat in the King Arthur position.

On the east side of the room, paint spattered, cloudy windows overlooked Michigan Avenue with its steady stream of traffic at all hours of the day. The sounds of cars and trucks on the streets were overlaid with noises contributed by the old building itself: random clanking’s, creaking’s, banging’s, and groaning’s.

The classes varied: we discussed reading assignments; we brainstormed; we journaled; we recited. Then at last, we wrote. “Don’t stop to think; don’t compose; don’t pick up the pen until I say ‘stop!’”

Then we headed home to fix it up, and turn it in next week before class. I would lay mine on the pile and then slink down in my chair as she scanned them, hoping against hope that I had not yet again offended the angry gods of fiction – it could be brutal!

Often we had to stand up and “tell” our story. That way, she explained, you couldn’t disguise with pretty words the fact that there was no story.

Other times she would take someone’s draft, cross out two, three, even four paragraphs, hand it back to the writer and say “start here”. We were always “setting the stage,” she said, “you vastly underestimate your reader!”

One night she thrust a redacted story into the hands of its author, pointing to a page saying “read this.” When the student finished she went around the room asking each of us in turn what we heard. We got it all, all of us. Molly said the removed paragraph “explained the punchline.”

She looked at the writer: “Don’t do that!” Then she became quiet, laid her hands on the table, and looked up at the slowly spinning ceiling fan. When she finally spoke she said “Do you know the tuition barely covers the rent here?” She smiled at that; a rare thing, that smile.

She was serious again. “Write densely,” she said. “Make every word count. Don’t tell your reader what he can figure out for himself! Don’t tell your reader what you have already told him!”

“Think about this: a story does not take place on the page! A story takes place in the mind of a reader. Do you understand? A story is a collaboration between a writer and a reader. If you fail to engage your reader in that partnership, he will stop being your reader!”

The room was quiet. She respected that silence, giving us a few extra minutes before we put pen to paper that night. The work from that session was very good, even Molly said so.

Molly A. Daniels-Ramanujan a.k.a. Shouri Daniels was a highly acclaimed author, educator, and critic.

She taught Creative Writing and Poetry at the University of Chicago and at her own school, The Clothesline School of Writing.

No student could be untouched by Molly’s profound understanding of and love for the written word. She demanded the best of us. She took us to places we didn’t know we could go.

Molly A. Daniels-Ramanujan passed away on November 26, 2015 at her home in Ithaca, New York.

Thank you, Molly, from all of us!